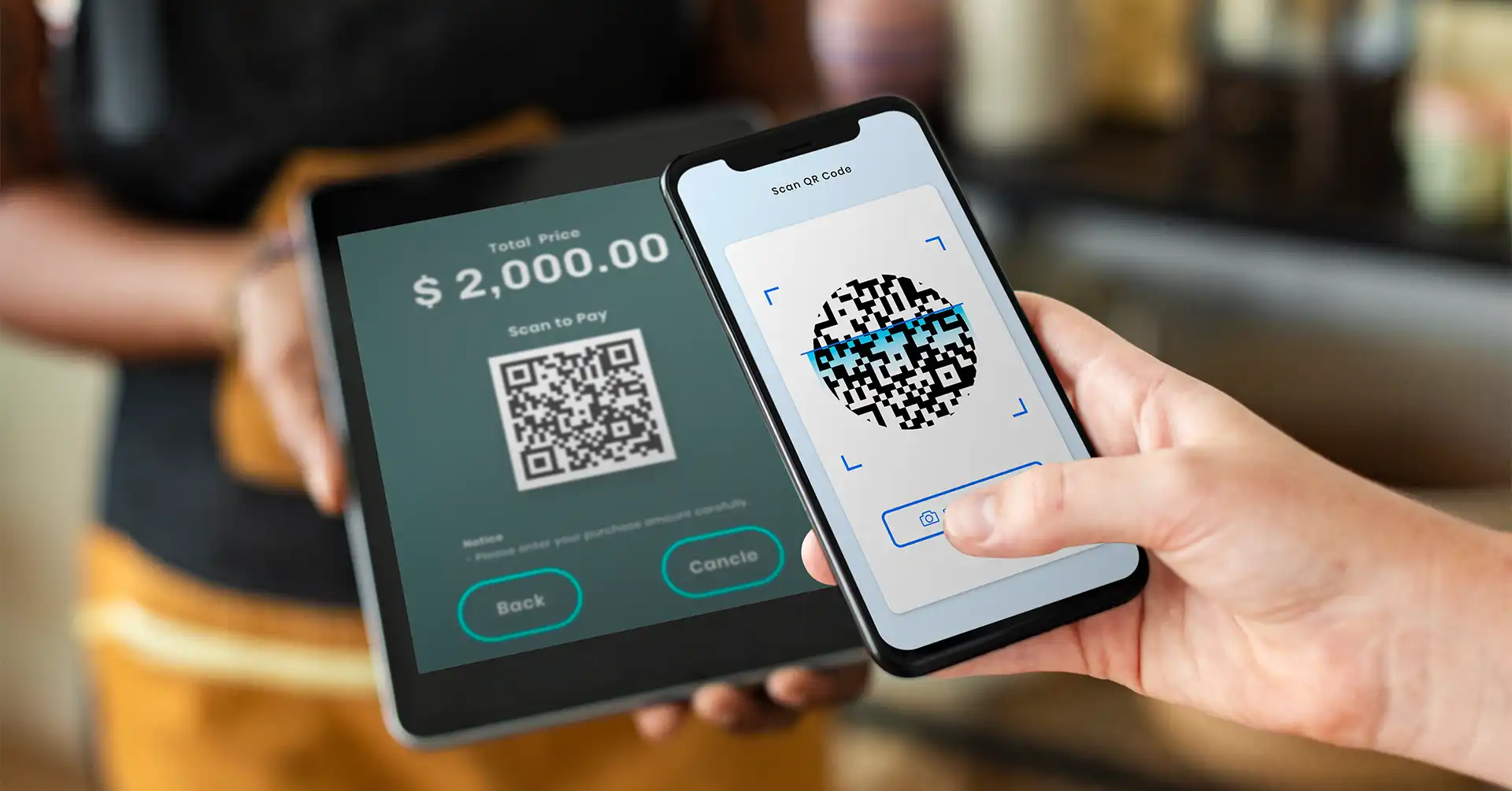

UPI, or Unified Payments Interface, is a revolutionary digital payment system in India that allows users to transfer funds instantly between bank accounts using their smartphones. Think of it as a super-convenient way to pay bills, split expenses with friends, or shop online without the hassle of cash or cards. With UPI, you can send money to anyone with a UPI ID, which is typically their phone number linked to their bank account, or even their QR code. This means no more scrambling for account numbers or worrying about entering them incorrectly. In this blog we will study about UPI Limit Per Day in details and how to manage this efficiently.

Benefits of Using UPI

Speedy Transactions: One of the biggest perks of UPI is its lightning-fast transaction speed. Whether you’re paying for groceries or settling a debt, your money moves in seconds, making UPI charges ideal for those who value efficiency.

Convenience: Say goodbye to tedious paperwork and long queues at the bank. With UPI, you can initiate transactions from the comfort of your couch, anytime, anywhere. It’s like having a bank teller in your pocket.

24/7 Accessibility: UPI doesn’t adhere to traditional banking hours. Need to send money in the middle of the night or on a holiday? No problem. UPI is available round the clock, ensuring you’re never stranded without access to your funds.

Security: Worried about the safety of your transactions? UPI employs advanced security measures, including multi-factor authentication and encryption, to safeguard your money. Plus, since transactions are linked directly to your bank account, there’s no need to preload wallets or share sensitive financial information with third parties.

Understanding UPI Transaction Limits

In the realm of digital finance, UPI (Unified Payments Interface) has emerged as a game-changer, streamlining peer-to-peer and peer-to-merchant transactions. However, within this seamless process lies a crucial aspect that users need to grasp: UPI transaction charges.

Definition and Importance

Simply put, UPI transaction limits refer to the maximum amount of money that can be transferred in a single transaction or within a specified time frame. These limits serve as guardrails, ensuring the safety and security of transactions while also preventing misuse or unauthorized access to funds.

Types of UPI Transaction Limits

When we talk about UPI transaction limits, it’s important to note that there are typically two main types:

Per Transaction Limit: This refers to the maximum amount of money that can be transferred in a single transaction. For instance, if the per transaction limit is $1,000, you cannot transfer more than that amount in one go.

Daily Transaction Limit: Apart from the per transaction limit, there’s also a daily transaction limit, which restricts the total amount of money you can transfer in a single day. This limit is usually higher than the per transaction limit but acts as an additional layer of security.

Impact of UPI Transaction Limits

How Limits Affect Users

When it comes to managing your finances efficiently, understanding the impact of influence your ability to transfer funds seamlessly. For instance, if you’re planning a big purchase or need to send money urgently, hitting the UPI transaction limit per month can disrupt your plans, causing inconvenience and delays.

Moreover, exceeding your UPI transaction limit per day may result in failed transactions, leading to frustration and additional charges. This limitation can be particularly frustrating when you’re in urgent need of making multiple transactions within a short span of time.

Strategies for Managing UPI Limit Per Day

Thankfully, there are several strategies you can employ to navigate around UPI transaction limits effectively. Firstly, planning your transactions in advance can help you stay within the prescribed limits. By scheduling transfers strategically, you can ensure that you make the most out of your daily allowance without encountering any setbacks.

Additionally, considering alternative payment methods for larger transactions can also be beneficial. For instance, opting for wire transfers or using credit cards for significant purchases can help you bypass the constraints of UPI limits per day, providing you with greater flexibility and convenience.

Furthermore, staying informed about any updates or changes in UPI transaction limits is essential. Banks may periodically adjust these limits based on various factors, so keeping yourself updated will enable you to adapt your financial strategies accordingly.

Recent Changes and Updates

In 2024, several significant updates have been made to the UPI transaction landscape, impacting users across the United States. These changes have been introduced by banks and regulatory bodies to enhance the efficiency, security, and accessibility of UPI transactions.

Enhanced Security Measures

One of the key updates revolves around bolstering security measures for UPI transactions. Banks have implemented stricter authentication protocols and enhanced encryption standards to safeguard users’ financial information. These measures aim to mitigate the risk of fraudulent activities and ensure that transactions remain secure and reliable.

Expansion of Transaction Limits

Another noteworthy change involves the expansion of UPI transaction limits per day. To accommodate the evolving needs of users and facilitate larger transactions, banks have raised the maximum transaction limits allowed within a single day. This adjustment provides users with greater flexibility and convenience when conducting financial transactions through UPI platforms.

Streamlined Processing Procedures

Additionally, updates in 2024 have focused on streamlining the processing procedures for UPI payment limit. Banks have optimized their systems and infrastructure to facilitate faster transaction processing times, reducing waiting periods and enhancing overall transaction efficiency. This improvement is aimed at providing users with a seamless and expedited transaction experience, particularly during peak usage hours.

Implications for Users

These recent changes in UPI transaction regulations have several implications for users in the United States. Firstly, the expansion of transaction limits per day enables users to conduct larger transactions, such as bill payments, fund transfers, and online purchases, without encountering restrictions. This increased flexibility empowers users to manage their finances more efficiently and conveniently.

FAQ on UPI Limit Per Day

What is the UPI limit per day?

The UPI limit per day refers to the maximum amount of money you can transfer in a single day using the UPI (Unified Payments Interface) platform. This limit is set by your bank and may vary based on factors such as your account type and transaction history.

How do banks determine the UPI limit per day?

Banks determine the UPI limit per day based on various factors, including your account balance, transaction history, and risk profile. They aim to balance security with convenience, ensuring that you can make transactions comfortably while safeguarding against potential fraud or misuse.

Can I increase my UPI limit per day?

Yes, many banks offer the option to increase your UPI limit per day based on your needs and eligibility. You can typically request a limit increase through your bank’s mobile app, website, or by contacting customer support. However, banks may require additional documentation or verification for higher limits.

What happens if I exceed the UPI limit per day?

If you exceed the UPI limit per day set by your bank, your transaction may be declined, or your account may be temporarily restricted from making further transactions. This is done to prevent unauthorized or fraudulent activity and protect your funds. It’s important to stay within your daily limit to avoid any disruptions to your banking activities.

Are there different UPI limits for different types of transactions?

Yes, banks may impose different UPI limits for various types of transactions, such as peer-to-peer transfers, merchant payments, or bill payments. These limits are usually tailored to the specific risks associated with each type of transaction and may vary based on your banking relationship and transaction history.

Conclusion

Understanding the UPI limit per day is crucial for navigating the world of digital payments securely and efficiently. By knowing the ins and outs of your daily transaction cap, you can make informed decisions about managing your finances and minimizing the risk of unauthorized transactions. With the convenience of UPI transactions comes the responsibility of staying within your limits, ensuring smooth banking experiences while safeguarding against potential fraud or misuse. As the landscape of digital payments continues to evolve, staying informed and proactive is key to making the most of this innovative payment platform while protecting your financial interests.

Also Read:

UPI Scams on the Rise: Navigating the Digital Threat Landscape

Paytm Strategic Partnerships: Ensuring UPI Business Continuity